housing allowance for pastors fannie mae

If your mortgage payment is 2000 a month but you could only rent the home for 1500 then your housing allowance is limited to 1500 a month. Pre-tax with housing allowance Roth and pre-tax without a housing allowance distribution.

Homestyle Renovation Fannie Mae

For example suppose a minister has an annual salary of 50000 but their total housing allowance is.

. The housing allowance for pastors is not and can never be a retroactive benefit. 10 Housing Allowance For Pastors Tips. Therefore the housing allowance is not reported on the personal tax returns as taxable.

Scenario 1 compares the three main account types pastors typically contribute to. This requirement does not apply to military quarters. Only expenses incurred after the allowance is officially designated can qualify for tax.

Include any amount of the allowance that you cant exclude as wages on line 1 of Form 1040. But if your church has only. Interest rate forecasts are based on rates from July 29 2022.

The payments officially designated as a housing allowance must be used in the year received. The IRS looks at the housing allowance portion of a pastors income as an exclusion from income. Many miss the opportunity and more than a few make some critical mistakes.

The IRS allows a ministers housing expenses to be. Clergy housing allowance is a commonly misunderstood income source for ministers and pastors but there are solutions to refinance build or buy a home. August 10 2022 Note.

If a clergys annual compensation is 65000 and their church has designated a housing allowance of 15000 they subtract that from their salary bringing their. B2-3-02 Special Property Eligibility and Underwriting Considerations. So if youre receiving 5000 in a housing allowance and the fair market rental value of the home dips to 4000 you can only exclude 4000 from your gross income.

Fannie Mae defines a manufactured home as any dwelling unit built on. All other forecasts are based on the date above. The housing allowance may be added to income but may not be used to offset the monthly housing payment.

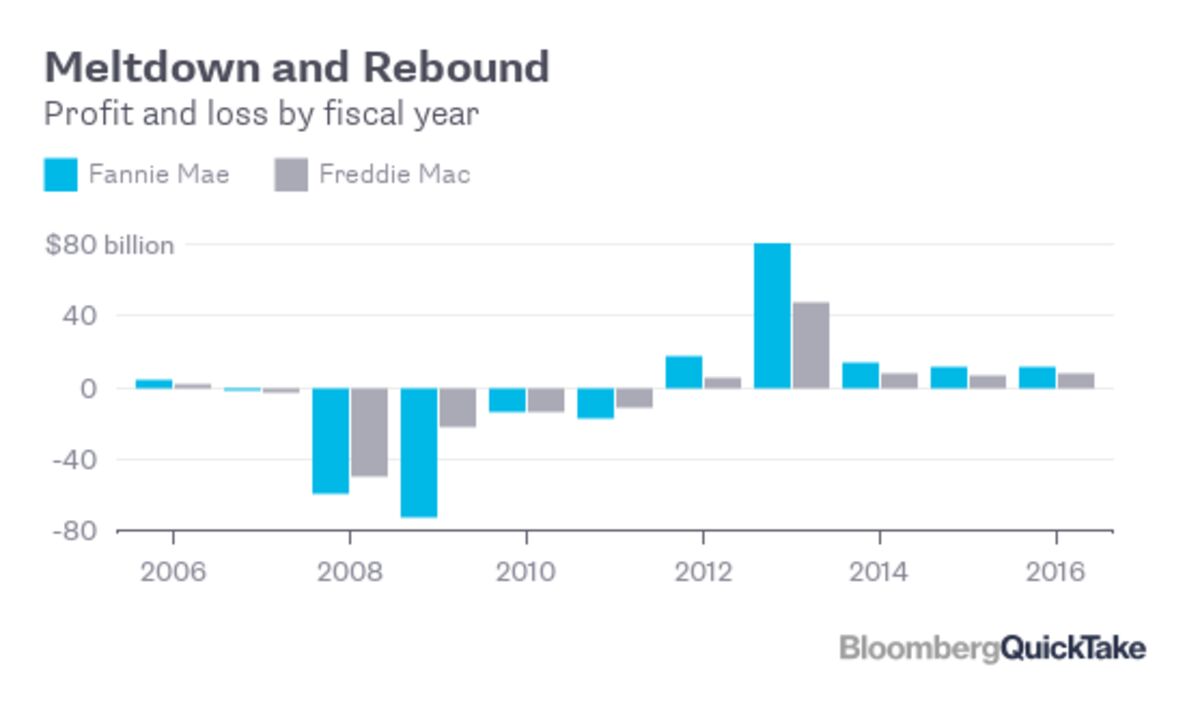

Ministers housing expenses are not subject to federal income tax or state tax. Today the Federal Housing Finance Agency FHFA proposed new benchmark levels for the m ultifamily housing goals for Fannie Mae and Freddie Mac the. In addition this is saving pastors a total of about 800 million a year.

All mortgage originations data are Fannie Mae. Here are four important things that you need to know concerning the housing allowance.

Fannie Mae And Freddie Mac Executive Bonuses C Span Org

Fannie Mae Profit Falls 81 On Huge Virus Related Expenses Bloomberg

Fannie Mae West President Optist Inc Linkedin

Benefits Professional Development Fannie Mae

2020 Housing Allowance For Pastors What You Need To Know The Pastor S Wallet

Fannie Mae Guidelines For The Appraiser

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Effective On 9 18 21 Fannie Mae Announced That Their Automated Underwriting System Will Now Take An Average Of The

Fannie Mae And Freddie Mac Bloomberg

Clergy Housing Allowance Mortgage Solutions To Buy A Home

Fannie Mae And Freddie Mac Executive Bonuses C Span Org

The Guide To Fannie Mae Homestyle Loans Rocket Mortgage

Fannie Mae S New Racial Bias Wsj

Why Fannie Mae And Freddie Mac May Need More Bailout Cash From Treasury Department National Mortgage News

Ansi Measuring Standard Required By Fannie Mae Appraisers Blogs

Fannie Mae S New Racial Bias Wsj

Mortgage Home Loans Could Be Easier With Fannie Mae Freddie Mac Plan

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Using A Pastor Minister S Housing Clergy Income For A Mortgage Loan Approval

How Do Pastors Clergy Or Ministers Qualify For A Usda Loan Usda Loan Pro